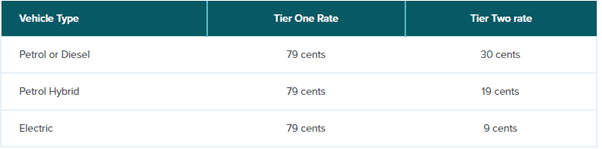

Chances are, you have a company vehicle used for both business and private. If you not sure what rate to use to claim your mileage expenses, use the rates listed below to calculate the allowable expense for using your vehicle for business purposes for the 2018-2019 income year.

Using the Tier One and Tier Two rates

The Tier One rate is a combination of your vehicle’s fixed and running costs. Use the Tier One rate for the business portion of the first 14,000 kilometres travelled by the vehicle in a year. This includes private use travel.

The Tier Two rate is for running costs only. Use the Tier Two rate for the business portion of any travel over 14,000 kms in a year.

Using Tier One and Two rates for employee reimbursement

If you’re an employer, you can use Tier One and Tier Two kilometre rates to get a reasonable estimate of costs. These will help when reimbursing an employee who has business-related use of the vehicle.

Your employee will need a record showing their business-related use of the vehicle over the income year, such as a logbook. You then use it to calculate the exempt portion of reimbursement using the kilometre rates we’ve set. For example, use the Tier One rate for the business portion of the first 14,000 kms (total) travelled by the vehicle in the income year, and then the Tier Two rates after that.

Contact the team at ITOAccounting if you need further assistance.